Gene Cooperman

For background information about this web site, and links to other

sources of information, see

http://www.ccs.neu.edu/home/gene/peakoil/peakoil-links.html.

To skip the prologue, go directly to the table of contents at

the end of this web page.

Today, there is a strong debate over when peak oil production will be seen: either in the next five years; or beyond the year 2030. Since the true state of affairs will have severe consequences for economic growth, the discrepancy is worth studying.

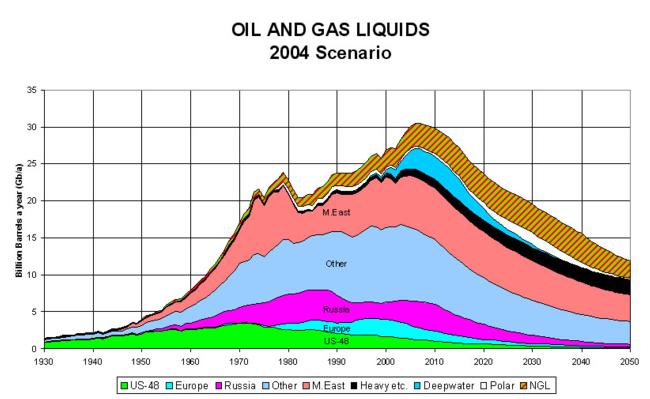

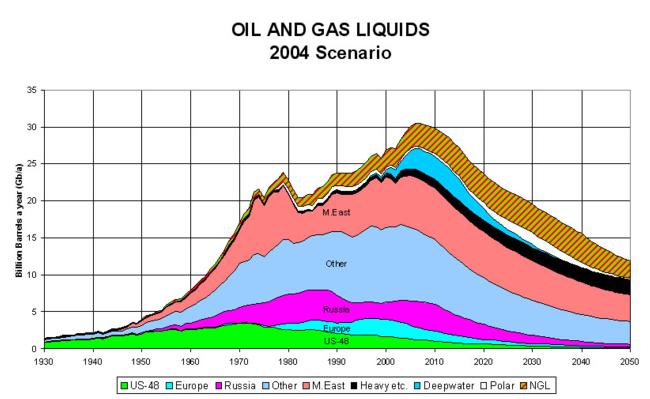

This is sometimes painted as a debate between a group of petroleum geologists [10,11,13] (peak in the next five years), and a group of economists [16,19] (peak beyond 2030). The geologists argue that the oil in the ground is finite, and the very low rate of new oil discoveries since 1990 shows that the end is approaching (as a gradual plateau followed by decreasing oil production). The economists argue that the laws of supply and demand dictate that as prices rise, we will both search harder to find new oil, and that we will raise recovery rates to extract more of the existing oil.

The petroleum geologists argue that the peak will arrive within about five years. They base their arguments on extrapolating current trends in world oil production. They use the IHS industry data bank containing data on most of the world's oil fields, along with current discovery and production statistics, as the basis for their argument. The reader can better appreciate this approach by reading Section 1 (Peak Oil in Regions around the World) at this point.

The economists' view is represented by the Energy Information Agency (IEA) of the United States and the International Energy Agency (IEA) of the industrialized nations. They argue that the peak will not arrive before 2030, and maybe much later. They base their arguments on the World Petroleum Assessment of the U.S. Geological Service (USGS) from the year 2000. That assessment is in turn based on the raw data of the U.S. Geological Survey from 1996. The 1996 survey assessed how much oil remains in the ground to be discovered. The 2000 assessment additionally assessed how much additional oil is to be recovered from existing fields through new technology and reassessments of the size of existing oil fields. Current oil price projections are also taken into account, to yield projects for a reference case, and a high and low price case.

The discrepancies of these two approaches are obvious for certain countries, like Indonesia. Based on estimated undiscovered oil, the EIA projects production of 1.5 million barrels per day from 1990 to 2025 for Indonesia. Yet current production in Indonesia is less than 1 million barrels per day, and is decreasing at approximately 10% per year. Consequently, the petroleum geologists predict declining production, based on the absence of significant new oil discoveries in Indonesia. Similar discrepancies hold for projections for the United States (flat versus declining production), the former Soviet Union (doubling of production versus flat production), etc. (See a comparison of the original statistics.)

The greatest controversy surrounds Saudi Arabia. The EIA predicts a doubling from 10% of today's oil production to almost 20% in 2025. (In the 2005 prognosis, they now limit Saudi Arabia to a 70% increase by 2025, but this is supplemented by a tripling of Iraqi oil production.) The petroleum geologists accept that Saudi Arabia has potential for limited increased production, but much less than double. Saudi Arabia previously reached its peak oil production of 9.9 million barrels per day in 1980. The potential of Saudi Arabia to double its production in future years remains untested.

The petroleum geologists strongly dispute that Saudi oil production can be doubled in the next 25 years. They base this on current production levels, the age of Saudi Arabia's currently producing oil fields, and hints of growing oil depletion found in scholarly oil journal articles by Saudi Aramco. Saudi Arabia has had no more of its celebrated discoveries of super-giant in the last 35 years. Specifically, most of current Saudi oil production is from oil fields discovered 50 years ago, while the last discovery of a super-giant oil field occurred 35 years ago [1].

Because the national oil company, Saudi Aramco, is a private company, owned by the Saudi royal family, there is a lack of public data concerning Saudi oil fields. However, Saudi official statements speak only of an increase of 20% production in the medium term, and 50% production in the long term. They do not talk of a doubling of oil production.

This report is in three sections. Section 1 demonstrates Peak Oil as a real phenomenon in the ``rest of world'' (excluding OPEC and the former Soviet Union), in the United States, in Western Europe (the North Sea). Section 2 provides a prognosis for future oil production and the arrival of peak oil. Section 3 considers the prospects for various alternative energy sources. Last, but not least, is References section. No one should ever accept an argument without having the ability to check the underlying facts.